FEES & CHARGES

Annual Fee Waiver:

Service Tax:

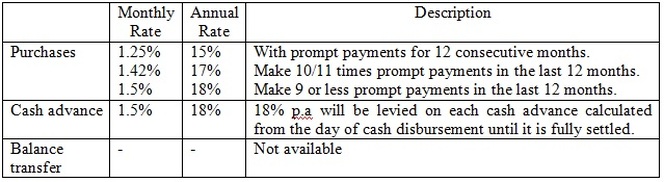

Finance Charges:

- Joining fee is waived

- Annual fee is waived for lifetime

Service Tax:

- Principal: RM50 per year

- Supplementary: RM25 per year

Finance Charges:

- Cash Advance Fee: 4% of the amount advanced or a minimum of RM40, whichever is higher will be imposed for each cash advance transaction.

- Minimum Monthly Repayment: 5% of the outstanding balance in the Line of Credit Account or a minimum of RM50 whichever is higher, and 100% on outstanding balance that exceeds line of credit limit.

- Late Payment Charges: 1% per month of the total balance outstanding due or a minimum of RM10, whichever is higher, up to a maximum of RM100.

- Interest Free Period: 20 days from the date of the monthly billing statement and only applicable to retail purchases for payment made in full by the payment due date.

- Conversion For Overseas Transactions: The conversion rate is as determined by MasterCard International or Visa International plus service charge of 1.5%.

Eligibility Minimum Age:

- Principal: 21 years

- Supplementary: 18 years

Minimum Income:

- Classic: RM24,000 p.a

- Gold: RM36,000 p.a

Documents Required For New Application:

- A photocopy of NRIC (both sides) including supplementary applicant's NRIC (if applicable)

- Latest B Form/BE Form with tax payment receipt or EA Form or EPF contribution statement or latest 2 months' salary slips

- Latest 3 months’ Company/Personal bank statement & Business Registration Certificate/Form 9/24/49 (for self-employed)

Application with income of RM24,000.00 to RM36,000.00 per annum is subject to the following credit card guidelines:

- Card members are allowed to hold cards from 2 card issuers only.

- Card limit - Not more than 2 times of gross monthly income.

- Plege of Fixed Deposits is permissible if proof of income requirement or supporting documents cannot be provided.

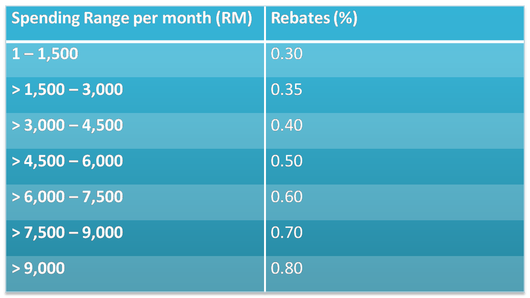

Cash Rebate up to 0.8%:

Synergy credit card also rewards you with up to 0.8% Cash Rebate on retail purchases (except petrol station purchases, cash advance and government related payments) charged to your card. (Please refer to table below)

50% Discount On Cash Advance Fee:

Enjoy 50% discount on the Cash Advance Fee, 2% or RM20, whichever is higher for the cash advance withdrawal on your Available Cash Balance within the first 6 months of your card membership. The normal Cash Advance Fee is 4% of the amount drawn or RM40 per Cash Advance transaction whichever is higher.

FREE Supplementary Card:

Enjoy annual fee waiver for all your supplementary cards. Give supplementary cards to your family members and loved ones so that they too will enjoy the convenience and privileges with you.

Enjoy 50% discount on the Cash Advance Fee, 2% or RM20, whichever is higher for the cash advance withdrawal on your Available Cash Balance within the first 6 months of your card membership. The normal Cash Advance Fee is 4% of the amount drawn or RM40 per Cash Advance transaction whichever is higher.

FREE Supplementary Card:

Enjoy annual fee waiver for all your supplementary cards. Give supplementary cards to your family members and loved ones so that they too will enjoy the convenience and privileges with you.